In light of potential extraction of unconventional gas in Ukraine the question of the future cost of this energy source is of vital importance. The main factors influencing the extraction’s cost are described beneath as well as the high level estimates of unconventional gas cost under different scenarios.

It should be stressed, that the figures provided, while the given estimates do not include neither the operational expenses, taxes, processing and transportation costs, nor the peculiarities of each specific well (vertical depth and horizontal length, geological conditions, number of stages and the scale of fracking operations etc.).

In general, the cost of natural gas production depends on two major factors: amount of investment needed for drilling a well and the well’s production rate or overall amount of natural gas, which could be extracted from the well during its lifetime.

Well Cost

As indicated of non-governmental organization “Friends of the Earth”, the cost of drilling a shale gas well in Europe will be several times higher than in US due to more complicated geological conditions, bigger depth of shale formations layers, higher population density and lack of necessary infrastructure and equipment.

Peter Richter, manager from Schlumberger, in November 2011 the cost of drilling a 2 kilometers long horizontal well in Poland at the level of USD 11 million comparing to USD 3.9 million in US. The information of gathered from leading oil and gas engineering companies also proves that the capital investment for shale gas well drilling in Europe will be 2-3 times higher than in the US. According to other estimates, the cost of drilling a well in Europe could be on average USD – million.

It should be remembered, that besides drilling and fracking costs there are also other not less important expenses, which are not directly linked to a specific well, including expenses for obtaining geological information, seismic surveys, pipelines construction, water storage and purification facilities, roads, environmental protection measures, etc. Therefore, the estimates of well cost provided by companies twice or even more times lower than the overall sum of capital investment during a year divided by the amount of wells drilled in that year. However, capital investment usually directed to the infrastructure assets and equipment, which will be used during many years and often for the time period longer than shale gas well operational lifetime.

It is also important to note, that at the stage of geological exploration the drilling of first exploration wells could take much longer time, and consequently be significantly more expensive comparing to drilling at commercial production stage. For example, it took Shell a year to drill its first exploration well in Ukraine Biliaivska-400, while the second well Novo-Mechybelivska-100 has been drilled during slightly longer than 3 months period. The cost of second well is taught to be significantly lower than the one near Biliaivka.

Higher well costs at the exploration stage may partly be explained by higher attention to investigation of geologic environment (core samples collection), definition of optimal technology and fracking fluid composition, as well as by investment in construction of infrastructure objects. At the same time, the first wells on the area besides potential flow of natural gas provide one more very valuable asset namely the information on geologic environment, which allows the evaluation of gas reserves and future optimization of the extraction process. Hence, it is not reasonable to use the cost of initial wells’ construction for the estimation of natural gas production cost.

In case of large scale drilling of new wells the cost will be decreasing especially if pad drilling technology will be applied. Additional cost reduction is possible after simplification of bureaucratic procedures, in particular, those relating to obtaining drilling permits, permits for importing of the equipment and technologies, permits for export of geological information for its further analysis etc.

In 2012 European Commission issued a report on potential impact of unconventional gas on energy markets in the European Union (““), prepared by Joint Research Center of the Institute for Energy and Transport. The report contains detailed analysis of three scenarios (optimistic, most likely and conservative) for the different parameters impacting the cost of unconventional gas production in Europe. According to the analysis, the average cost of drilling of the shale gas well ranges from 3 to 7,6 million Euro, and the cost of fracking ranges from 3,5 to 4,5 million Euro. Additionally, from 3,3 to 6,2 million Euro attributed to the construction of supplementary infrastructure (50% of drilling and fracturing cost).

| Expenses | Optimistic scenario | Most Likely Scenario | Conservative Scenario |

| Well Drilling, Euro | 3 003 000 | 4 337 000 | 7 565 000 |

| Fracking, Euro | 3 500 000 | 4 200 000 | 4 900 000 |

| Additional Infrastructure, Euro | 3 251 500 | 4 268 500 | 6 232 500 |

| Total expenses, Euro | 9 754 500 | 12 805 500 | 18 697 500 |

The total cost of well drilling, infrastructure construction and hydrofracking operation estimated in the range of 9,75-18,7 million Euro. Under the most likely scenario the overall costs of a shale gas well will constitute 12,8 million Euro or 15,8 million US dollars (based on ).

Well Productivity

The volume of natural gas production from a single well depends on the initial production rate after fracking of the well and also from the speed of production rate decline. Both the initial production rate and the decline curve depend on geological conditions and the efficiency of hydrofracking operation, and thus the well productivity could significantly differ even on a single field. Some wells could be “dry” and will not provide commercial valuable gas flow, the other wells could ensure the gas flow sufficient for returning the investment and receiving profit, while the next part of the wells could turn out to be a pot of gold.

In the estimation of potential shale gas production volumes at Oleska area we have used the following three scenarios:

- pessimistic scenario – initial natural gas flow rate is about 28 thousand cubic meters per day;

- baseline scenario – initial natural gas flow rate is about 57 thousand cubic meters per day;

- optimistic scenario – initial natural gas flow rate is about 114 thousand cubic meters per day;

In each scenario the well debit decreases by 70% during the first year of production, additionally by 30% during the second year, by 15% during the third and the fourth years, and by 10% more during the fifth and subsequent years.

Total volume of shale gas production during 7 years of wells’ exploitation according to the assumptions presented above will be:

- 21,7 million cubic meters in pessimistic scenario;

- 43,4 million cubic meters in baseline scenario;

- 86,8 million cubic meters in optimistic scenario.

These values of total production as well as the estimates of well drilling and fracking cost presented earlier have been used for the evaluation of potential range of shale gas extraction cost in Ukraine.

Shale Gas Extraction Cost

With the big level of uncertainty for major factors (drilling and fracking cost, initial production rate and decline rate) any estimates of potential shale gas production cost in Ukraine are very shaky. Yet it is possible to provide preliminary estimates of potential production cost based on the defined scenarios.

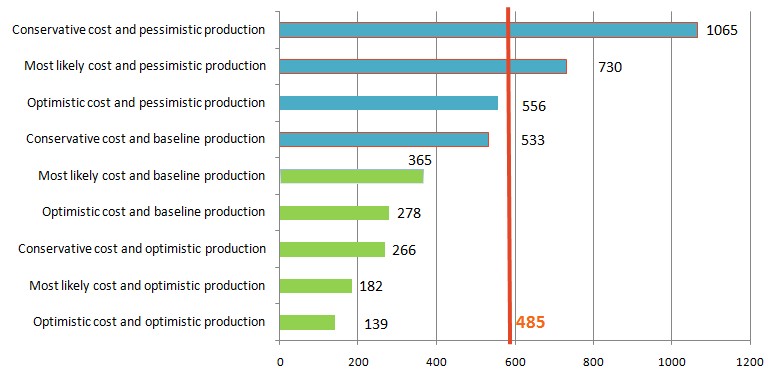

According to our calculations, the cost of shale gas production under different scenarios fluctuate in the broad range from USD 139 to USD 1065 per 1000 cubic meters proving the high level of uncertainty. In the averaged scenario (the cost of well construction is USD 15.8 million and the total production of natural gas is 43,4 million cubic meters) the cost of natural gas could be 365 dollars per 1000 cubic meters. With the proposed import price of Russian natural gas supplied by Gazprom at the level of USD 485,5 per 1000 cubic meters shale gas has all chances to be competitive on Ukrainian energy market.

Read also:

UEF 2014: 7 Key Messages On The Development Of Gas Sector In Ukraine

UEF 2014: Unconventional Gas Production Perspectives In Ukraine

The results of geologic-exploration works on main areas in Ukraine will help to narrow down the range of potential unconventional gas production cost and present more accurate estimates. If the exploration wells will not prove availability of commercial viable natural gas flow rates, the companies involved in the projects will not have any grounds for moving to commercial production and unconventional gas will not have any impact on the energy market: there simply will be no unconventional gas production. If the results of pilot drilling will be optimistic, than the drilling and fracking cost will be gradually reducing over time lowering the cost of natural gas production. The price for unconventional gas will be defined by market conditions, however additional supply of the shale or tight sand gas will help to diversify energy sources supply, increase the competitiveness on the energy market and reduce the dependence on import from Russia, reducing significantly any future subjective gas price shocks.